Alpha Shield Market Signal

Dodge Market Crashes – Outperform – Protect Your Financial Future

Stay Ahead of Market Volatility with Data-Driven Signals and Risk Management Solutions.Data-driven signals for smarter investing.

Why Choose Alpha Shield?

Three powerful advantages that set us apart

Crash Protection

Shield your investments from market downturns with advanced risk management that prompts you to step aside before major crashes.

Outperformance

Beat the market consistently with data-driven signals that surface opportunities and calibrate exposure for maximized returns.

Simplicity

Get clear, actionable guidance without complexity. Our concise daily updates make professional-grade investing accessible.

Every day, Alpha Shield delivers a single, crystal-clear signal — IN (Risk ON) or OUT (Risk OFF).

No Noise. No Overthinking. Just Actionable Clarity.

When the market is IN, invest in SPY or QQQ. When it's OUT, move to IEF, TLT, or Cash/BIL.

A fully rule-based system that adapts to market stress in real time — emotion-free and proven through multiple crises.

How It Works?

Under the Hood of the Alpha Shield Market Signal

Alpha Shield decodes the VIX Futures Curve, the market's own fear gauge, to detect when risk is building beneath the surface.

It blends multiple volatility and curve-slope metrics, scores them in real time, and issues one daily instruction:

Stay IN or step OUT.

Systematic – Driven by data, not opinion.

Actionable – Trade once per day, ONLY if the signal changes.

Transparent – You control your own brokerage account.

No Hype. No Emotion. No Second-Guessing.

Clarity and Transparency

What Alpha Shield Is Not

Understand the boundaries of the system so you know exactly what to expect—no hype, no false promises.

Not a day-trading tool

- Only one signal per day—no scalping or intraday chasing.

- Designed to ride major market trends and sidestep severe drawdowns.

- Aims for disciplined allocation, not short-term price noise.

Not immune to down days

- Markets fluctuate—even during strong "IN" phases.

- Short-term setbacks can happen while trends develop.

- The goal is to limit deep drawdowns and stay aligned with the regime.

Not a shorting strategy

- Shorting SPY on "OUT" signals proved inconsistent in testing.

- Occasional inconclusive "OUT" readings make short exposure unreliable.

- We prioritize capital preservation via cash or Treasury ETFs (IEF, TLT, BIL) in risk-off regimes.

In short, Alpha Shield helps you sidestep the big crashes—not every minor dip—and keeps your capital on the right side of the market over the long run.

About the Team behind Alpha Shield

We are former investment bankers and global markets professionals with over 50 years of combined experience at leading global institutions.

In 2017, we left the corporate world to build a system to manage our own money and that followed three core principles:

Preserve capital and control risk.

Follow a systematic, emotion-free process.

Keep it simple — one clear daily decision.

Our goal was to avoid major drawdowns of a typical buy-and-hold strategy.

After years of research and live testing, Alpha Shield was launched in 2019.

It now manages 100% of our own portfolio — and has outperformed through every major crash since.

Backtested since 2008. Live-Tested since 2019.

Our Battle-Hardened Algorithm - Alpha Shield - has navigated many storms, including:

- ·The Great Financial Crisis (2008),

- ·EU Debt Crisis (2011),

- ·China Market Crash (2016),

- ·"Volmageddon" (2018)

- ·Covid Crash (2020)

- ·2022 Market Correction (2022)

- ·2025 Market Correction (2025)

| Notable Market Crashes / Drawdowns | Return Over Period | |||

|---|---|---|---|---|

| Event | Start | End | SPY | Alpha Shield |

| GFC - Sub Prime | 5/18/2008 | 4/23/2009 | -38.35% | -5.45% |

| EU Debt Crisis | 7/22/2011 | 11/28/2011 | -11.05% | 2.15% |

| China Mkt Crash | 7/21/2015 | 2/11/2016 | -13.64% | 0.84% |

| Volmageddon | 1/31/2018 | 2/8/2018 | -8.61% | 0.01% |

| Covid | 2/19/2020 | 3/23/2020 | -34.10% | 1.51% |

Performance Comparison

Alpha Shield vs SPY Performance Over Time

Cumulative returns comparison showing Alpha Shield's consistent outperformance

Cumulative Returns Since 2019 (Live Trading)

Cumulative Returns Since 2008 (Backtest)

When backtested back and then used in live trading (since 2019) the Alpha Shield Strategy not only managed to significantly reduce portfolio volatility and drawdowns, but it also managed to greatly outperform the market:

Year-to-Date Performance Summary (as of 10 October 2025)

Historical Performance Summary (Backtest Since 2008)

Since Inception (Live Trading Jan 2019)

Start Receiving Alpha Shield Dashboard and Market Signal Today

Make the choice to Preserve Your Capital, generate superior risk-adjusted returns with no emotional bias.

Access our real-time daily signal with straightforward asset allocation and position sizing recommendations tailored for disciplined investors.

- 💎$30 / month

- Daily IN/OUT Signal via Dashboard + Email + WhatsApp/Discord

- Simple ETF Allocation and Position Sizing Guidance

- Live Performance and Metrics Dashboard

- Educational Resources + "Inside the Algo" + Nerd Section

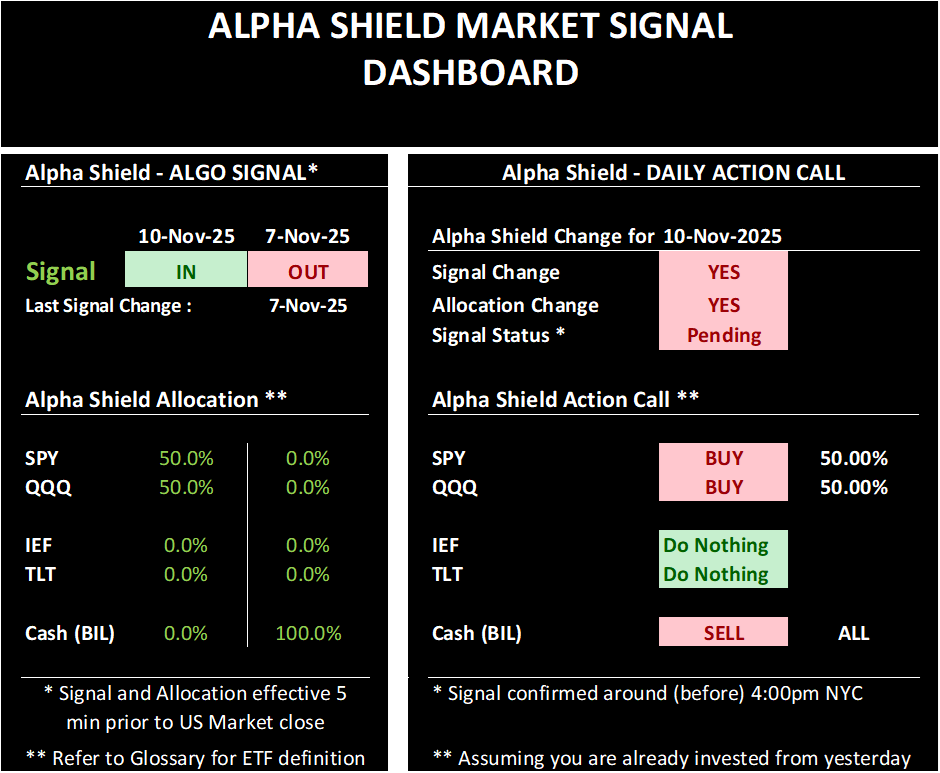

Preview of the Alpha Shield Dashboard

Why Choose Alpha Shield?

- ✅Protects capital during major crashes

- ✅Outperforms the S&P 500 on a risk-adjusted basis

- ✅Emotion-free, rule-based discipline

- ✅Simple ETF implementation — no complex trades

Stop Guessing. Start Protecting.

Subscribe today and take control of your market destiny.

Resources

Educational content and insights to help you become a smarter investor

Investing Basics for Beginners

Learn the fundamentals of investing, portfolio management, and risk assessment. Perfect for those starting their investment journey.

Content coming soonHow VIX Futures Impact Market Volatility

Understand the relationship between VIX futures, market volatility, and how Alpha Shield uses these signals to protect your portfolio.

Content coming soonBacktesting Insights

Learn from historical market events. Discover how Alpha Shield performed during the 2008 financial crisis, the 2020 COVID crash, and other major market downturns.

Key Lessons:

- 2008 Financial Crisis: How early warning signals helped minimize losses

- 2020 COVID Crash: Rapid market recovery and position management

- Volatility spikes and portfolio protection strategies

Testimonials

What investors say about partnering with Alpha Shield

Frequently Asked Questions

Find answers to common questions about Alpha Shield

FAQ content will be added soon. Please check back later or contact us for immediate assistance.

Contact Us

Have questions or want to learn more? We'd love to hear from you. Send us a message and we'll respond as soon as possible.